If contractors and suppliers don’t get paid on a construction project in Texas, they can file a mechanics lien to secure payment. A mechanics lien is a legal tool that provides the unpaid party with a security interest in the property. This page breaks down the rules, requirements, and deadlines you need to follow to file a Texas mechanics lien.

“Levelset takes something that is pretty complex and makes it easy.”

In Texas, parties who contract directly with the property owner are not required to send a preliminary notice in order to retain lien rights.

Additionally, it can help to send notice to a construction lender, if any is involved on the project.

On residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month the contract was completed, terminated, or abandoned.

On non-residential projects, the lien filing deadline is the 15th day of the 4th month after the month the contract was completed, terminated, or abandoned.

Enforcement deadlines 1 or 2 yearsIn Texas, an action to enforce the lien must be initiated within 1 year of the last date the claimant could file a lien.

On residential projects in Texas, an action to enforce the lien must be initiated by the later of a) 1 year after the last date on which the lien claimant could file the lien, or b) 1 year after termination, completion, or abandonment of the project.

On non-residential projects, an action to enforce the lien must be initiated by the later of either: 1) 2 years after the last date on which the lien claimant could file his lien, or 2) 1 year after termination, completion, or abandonment or the project.

Preliminary notice requirementsOn residential projects, subcontractors and suppliers must send must send a preliminary notice to the owner and prime contractor by the 15th day of the 2nd month following the month that work was performed and unpaid. (Notice must be sent for each month work was performed and unpaid.)

On non-residential projects, first-tier subcontractors and suppliers (those who contract with the prime contractor) must send notice by the 15th day of the 3rd month following each month work was performed and unpaid. For example, if work was performed in January, notice would be due no later than April 15th.

Subs and suppliers who contract with anyone other than the direct contractor on non-residential projects must send a notice by both the 15th day of the 2nd month, and the 15th day of the 3rd month following each month in which work was performed and unpaid.

Mechanics lien deadlines 15th day, 3rd or 4th monthOn residential projects, the deadline to file a Texas mechanics lien is the 15th day of the 3rd month after the month in which the claimant last provided labor or materials.

On non-residential projects, the lien filing deadline is the 15th day of the 4th month after the month in which they last furnished labor or materials to the project.

Enforcement deadlines 1 or 2 yearsIn Texas, an action to enforce the lien must be initiated within 1 year of the last date the claimant could file a lien.

On residential projects in Texas, an action to enforce the lien must be initiated by the later of a) 1 year after the last date on which the lien claimant could file the lien, or b) 1 year after termination, completion, or abandonment of the project.

On non-residential projects, an action to enforce the lien must be initiated by the later of either: 1) 2 years after the last date on which the lien claimant could file his lien, or 2) 1 year after termination, completion, or abandonment or the project.

TopicContractors, subcontractors, suppliers, property owners, construction lenders, and other vendors will encounter all kinds of lien-related paperwork and questions when working on Texas construction jobs. Here are some of the common issues you may encounter, and answers written by Texas construction attorneys and payment experts.

NOTE: There are some significant changes to the Texas lien laws for all original contracts entered into on or after January 1, 2022. These FAQs break down both the current rules and the pre-1/1/22 rules.

In Texas, original contractors (GCs), subcontractors, material suppliers, specialty material fabricators, design professionals, and landscapers all have the right to file a mechanics lien if they do not receive payment.

Parties who contracted directly with the owner of the property in Texas can file a constitutional lien. There are no notice or filing requirements for a constitutional lien, but claimants must meet specific requirements.

Generally, there are no specific licensing requirements for contractors to secure lien rights in Texas. However, design professionals such as architects, engineers, and surveyors must be licensed, if required, to be eligible for lien protection.

Generally, Texas imposes no specific requirement that a contract be in writing to be eligible for lien protection. However, prime contractors on homestead properties must have a written contract with the property owner to be able to secure lien rights on the project.

The same general rules apply, however, design professionals such as architects, engineers, and surveyors are required to have a written contract to be able to file a Texas mechanics lien.

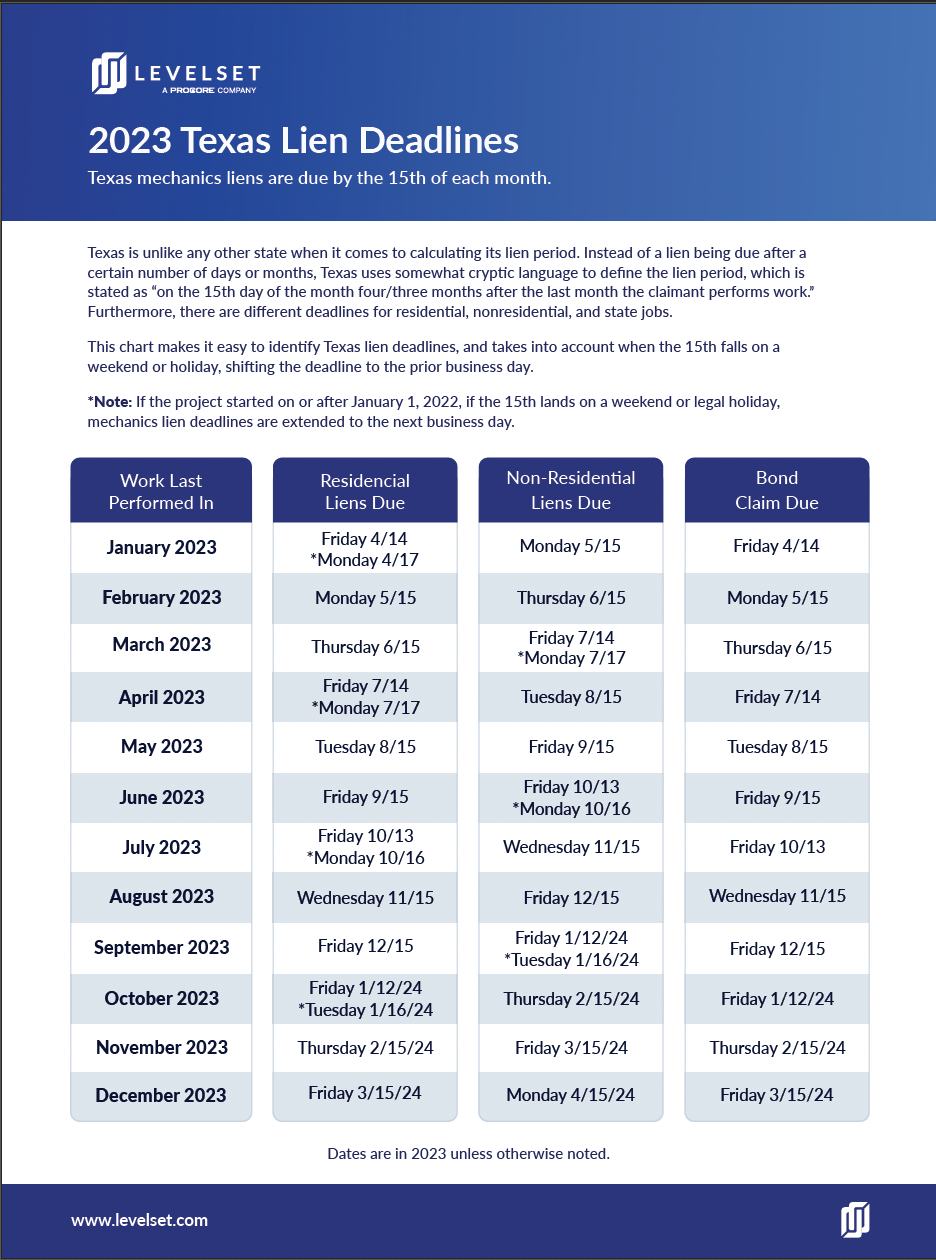

The deadline to file a Texas mechanics lien varies depending on the type of project, and the claimant’s role.

Commercial projects

Direct contractors must file their lien no later than the 15th day of the 4th month after the month their contract was completed, terminated, or abandoned.

All other claimants must file their lien no later than the 15th day of the 4th month after the month they last furnished labor and/or materials to the project; or the 15th day of the 4th month after the month the claimant would normally have been required to deliver the last of the specially fabricated materials that have not actually been delivered.

Residential projects

Direct contractors must file their lien no later than the 15th day of the 3rd month after the month their contract was completed, terminated, or abandoned.

All other claimants must file their lien no later than the 15th day of the 3rd month after the month they last furnished labor and/or materials to the project; or the 15th day of the 3rd month after the month the claimant would normally have been required to deliver the last of the specially fabricated materials that have not actually been delivered.

* Note: if the 15th lands on a weekend or federal holiday, the deadline is pushed to the following business day.

→ Download the Texas Lien Deadline Calendar for an easy-to-read list of current deadlines, updated annually.

The same general rules apply, however, if the deadline falls on a weekend or federal holiday, the deadline is pushed to the previous business day.

Yes, contractors and suppliers can file a mechanics lien on a homestead in Texas. However, they must meet additional requirements in order to retain their right to claim a lien.

In order for anyone on the project to retain lien rights, the general contractor must provide the homeowner with a written contract. The contract must be signed by both spouses (if married), executed prior to any work on the project, and filed with the county clerk.

In addition, Texas requires claimants to inform the property owner of their rights and responsibilities using specific language.

A Texas Affidavit of Lien must be signed by the person claiming the lien or by another person on the claimant’s behalf and must contain the following information:

• A sworn statement of the amount of the claim;

• Owner’s name and address;

• Claimant’s name & address;

• Brief description of labor and/or materials furnished;

• Hiring party’s name & address

• General contractor’s name & address

• Property description

• For claimants other than direct contractors:

• A statement of each month in which work was done and materials furnished for which payment is requested

• A statement identifying the date each notice of the claim was sent to the owner and the method by which the notices were sent.

This is tricky. The state of Texas requires that the lien statement include a description of the property “legally sufficient for identification.” The determination of what constitutes such a description is complex.

The Texas Supreme Court has held that, for the purposes of a lien claim, a description of real estate is sufficient when it would “enable a party familiar with the locality to identify the premises intended to be described with reasonable certainty, to the exclusion of others.”

While this rule has been followed by other Texas courts, it is not easy to apply such a rule in real life, and not including a legal description would subject the lien claimant to a situation in which it is unclear until enforcement if the description provided is sufficient. Best practice would be to include at the minimum a lot and block number, in addition to the property address – and even better would be a full legal or metes and bounds description of the property.

No, any amount unrelated to the value of the labor and/or materials furnished may not be included in your lien amount in Texas. However, legal fees and interest may be awarded to a successful lien claimant by the court.

Texas doesn’t require notarization for mechanics liens. However, state law requires that the lien be verified by the oath of the person filing or some other person with knowledge of the facts.

Texas mechanic lien claims are documents recorded with the county recorder office. For your mechanics lien to be valid, you must record it in the county where the job is physically located. Texas has a lot of counties, and all of those counties have their own unique rules and requirements.

A Texas Affidavit of Lien must be in the proper format, include the required information, and filed in the county recorder’s office of the county where the property is located within the statutory timeframe.

Yes. Claimants must send a copy of the lien affidavit to the property owner and the prime contractor by certified mail not later than the 5th business day after you filed the lien with the clerk. It is acceptable to send the notice to the owner and prime contractor before filing the notice, or at the same time.

Yes. A mechanics lien may be filed against a condominium project in Texas to the extent you are a party otherwise allowed to file a mechanics lien.

All Texas mechanics liens must be enforced no later than 1 year after the last date the claimant could have filed their affidavit of lien.

Additionally, the enforcement deadline may be extended by filing an agreement signed by the claimant and the property owner. However, the enforcement deadline may not be extended beyond two years after the date the claim was filed.

The deadline to enforce a Texas mechanics lien varies depending on the type of project.

Commercial projects:

• 2 years after the last date on which the lien claimant could file his lien, or

• 1 year after termination, completion, or abandonment of the project; whichever is later.

Residential projects:

• 1 year after the last date on which the lien claimant could file his lien, or

• 1 year after termination, completion, or abandonment of the project; whichever is later

Generally, no. Texas mechanics liens have priority over other encumbrances on the property, including construction loans and mortgages, if the competing encumbrance is recorded after work commences on the project (after the “first spade of dirt is turned”).

However, the lien of a design professional (architect, engineer, surveyor) is only perfected on the date the lien is actually filed. Therefore, unless the design professional’s lien is filed prior to the beginning of any work on the project, it will be subsequent to any other mechanics liens.

As between competing mechanics liens, (except liens of design professionals, as described above) all have equal priority and will share pro-rata if the sale of the property is insufficient to satisfy all claims.

Lien priority can be complicated, but it’s rare that a case gets far enough for it to matter. What’s most important is that, when a contractor or supplier isn’t paid for their work or materials, filing a mechanics lien is one of the most effective tools to collect payment.

When the lien is satisfied, the lien claimant is required to release the lien no later than the 10 th day after the date a written request to release the lien is received. The property owner, the general contractor, or any other person making payment to the lien claimant may request the release of the lien. However, the release of one mechanics lien does not prevent future lien filings in Texas.

You really do need to retain a construction attorney to evaluate your documents and situation and to provide advice. The guidance will be tailored to whatever your situation is.

Answered by Brian Erikson | Attorney https://www.levelset.com/payment-help/question/demand-to-cease-threats/It sounds like if the lien was filed Which would be the main reason for them to push back the way they are they are trying the scare you off I deal with situations like this all the time I would actually love to help you get this handled give me a call at 972-872-8783 Lets speak on this and see if i can help you sort this out

Answered by Joshua Grider | CEO https://www.levelset.com/payment-help/question/can-i-file-a-mechanics-lien-301/The Deadline for Filing a Mechanics Lien in Texas Is the 15th of the 4th month After work was completed or Supplied Assuming you have provided the necessary monthly notices, and typically you need the help of an Experienced and Licensed Collections agent to help facilitate and Even close on the Lien like myself Give me a call at 972-872-8783 if you have more questions about this or want my help even.

Answered by Joshua Grider | CEODownload a free infographic detailing the changes here: Texas 2022 Lien Law Changes Overview

Texas’ mechanics lien laws provide substantial protection for contractors and suppliers. However, there are many requirements that must be followed in order for a construction participant to qualify for, secure, perfect, and enforce lien rights. This page provides frequently asked questions about Texas’ mechanics lien laws and rules, the lien statutes, and a breakdown of the lien and notice details for contractors and suppliers in Texas.

The Texas property code outlines three primary categories of parties who are able to file a mechanics lien:

General contractors, subcontractors, and material suppliers all have lien rights under the first category. Texas law doesn’t distinguish between subcontractors and suppliers for the purpose of lien and notice requirements.

Parties who specially fabricate materials for certain projects have lien rights in Texas, as well. The lien rights mirror those of any other supplier except for the fact that, if the materials are not suitable for use in another project, the fabricator may claim a lien even if the materials are not delivered to or incorporated into the improvement.

Finally, design professionals are also entitled to Texas mechanics lien rights.

In Texas, construction participants who contract directly with the property owner generally do not need to send notice to retain the ability to file an effective mechanics lien. However, everybody else on the project may have to send multiple monthly notices in order to keep their mechanics lien options open.

Unlike many states, Texas doesn’t have a single preliminary notice that must be sent at the start of the project to retain lien rights. Instead, Texas requires parties to send notices for each and every month that they provided labor or materials (but haven’t been paid for them).

So a subcontractor or supplier on a long project who is subject to slow payment (or is not being paid at all) will likely need to send multiple notices. And, these monthly notices are in addition to other notices (like notices for retainage or notices for specially fabricated materials). For more on these notices see:

*2022 Note: A Notice of Specially Fabricated Materials is no longer be required for projects that began on or after 1/1/22.

Further, 2nd tier subcontractors and suppliers (parties who contract with someone other the GC/prime contractor) may be required to send multiple notices for each month in which they didn’t receive payment for labor or materials.

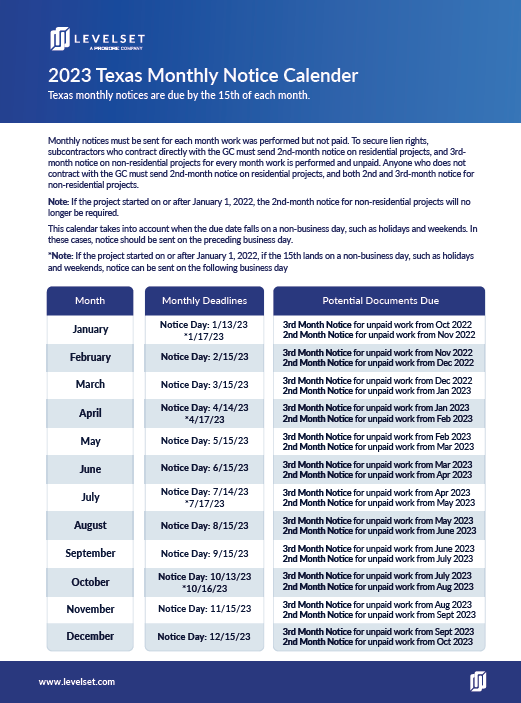

These monthly notices are always due no later than the 15th day of the month either 2 or 3 months after the unpaid for labor or materials were furnished. The amount of potentially required notices can be confusing.

This calendar takes the guesswork out of calculating the deadline for your Texas monthly notices. We update it annually.

Texas law makes lien deadlines extremely confusing. The 15th of every month is a deadline for someone. But your deadline is based on the type of project you are working on. It’s calculated from the month that you provided labor or materials for which you weren’t paid.

This calendar takes the guesswork out of calculating the deadline for your Texas lien claims. We update it annually.

Generally speaking, Texas requires parties to file a mechanics lien by the 15 th day of the 4 th month after the month in which the lien claimant last furnished labor or material to the project.

In order to also protect the lien claimant’s claim against the retainage at the same time, they should file the lien within 30 days after the completion of the overall project (not their own date of last furnishing).

However, if the project is residential in nature, the lien filing deadline is the 15 th day of the 3 rd month following the month in which the lien claimant last furnished labor and/or materials to the project.

Claims against retainage must be filed by the 15 th day of the 4 th month following the month in which the lien claimant last furnished labor or material to the project AND not later than 30 days after the entire project is completed, abandoned, or terminated. (For parties on a residential project, the deadline is reduced to the 3 rd month.)

However, this deadline can be changed if the property owner takes specific action; such as:

The lien form in Texas is known as an Affidavit of Lien. There are two different forms, depending on a party’s role on the project.

There are three general steps to file a mechanics lien in Texas:

Read the comprehensive guide: How to file a mechanics lien in Texas.

It’s nearly always a requirement for claimants to record a mechanic lien. However, Texas provides original contractors with a “constitutional” mechanics lien that is effective without the need for filing. However, any contractor’s ultimate goal in recording a lien is to get paid. Since recording a lien provides notice of the claim to third parties (like potential buyers or financiers of the property), recording the lien is a best practice in all situations.

The constitutional lien is not completely automatic, though. To the extent that work is performed on a homestead property, there are still specific actions that contractors must take and requirements they must meet.

The contractual requirements outlined above do not go away just because the lien being claimed is constitutional rather than statutory. There is no specific requirement to file a lien affidavit in order to claim a constitutional lien against homestead property. However, the Texas Constitution itself sets forth specific requirements that must be met in order to get around the general protection of homestead property from forced sale.

A Texas lien isn’t effective forever, mechanics liens do expire. Unlike many states, liens filed in Texas have a pretty long shelf life. In Texas, the general rule is that the deadline to foreclose on the lien claim is one year from the last date the claimant could have filed a lien.

*2022 Note: The deadline to foreclose claims on projects under the pre-2022 changes, is the later of:

• 2 years(1 year for residential projects) from the last day a mechanics lien can be filed for commercial projects or;

• 1 year from completion of the work.

Foreclosing on a mechanics lien isn’t always worth it. It’s a full-blown lawsuit, with all of the expense and headache that comes with it. If a lien claimant is having trouble collecting their payment after filing a lien, sending a Notice of Intent to Foreclose can be an effective way to get the owner to pay. They want to avoid the cost and time involved in a court proceeding just as much as anyone.

In Texas, a lien claimant must release their claim if:

The process is fairly straightforward, it’s a simple document referencing the filed affidavit of lien that is filed in the same office where the claim was filed. However, even when it is not a requirement, filing a lien release is just good business practice.

While Texas mechanics lien law protects construction businesses broadly, Texas also provides strong protection for the state’s homeowners.

Texas has offered strict protections to a person’s “homestead” throughout history, both with respect to mechanics liens and with respect to other debts and judgments. The general rule in Texas is that a property upon which the owner resides is his/her homestead. (Although for people who split time between two or more properties, only one property may be a homestead.) In any event, however, it is best practice for contractors in Texas to treat all owner-occupied residential property as a homestead for mechanics lien purposes.

When a construction project occurs on a homestead property, there are specific requirements that must be met in order for any project participant to qualify for mechanics lien protection.

In order to file Texas mechanics liens on a homestead, the GC/prime/original contractor and the owner must execute a written contract setting forth the terms of their agreement. However, merely having a written contract is not enough by itself.

There are multiple requirements the contract must meet and actions the contractor must take:

The contract be signed by both spouses (if the owner is married) even if the property is only in the name of only one spouse. If the property owner is married and the contract is not signed by both parties, no mechanics lien is allowed to be filed against the property. This puts the potential lien claimant in a position where he must explicitly ask or otherwise determine if the property owner with whom he is contracting is married in order to meet the duty imposed by Texas lien law.

What all of this means for sub-tier parties on homestead construction projects, though, is that their mechanics lien rights are entirely dependent upon the actions of the GC (or prime/original contractor) before the project even begins.

Before you start, read the step-by-step guide to filing a Texas mechanics lien. This article walks you through the monthly notice process, timing, and form requirements to file a valid lien claim in the state of Texas.

Texas requires a different mechanics lien form, known as an Affidavit of Lien, depending on your role on the project.

Texas law is pretty strict about the information required on a mechanics lien form. It’s important to get the details exactly right. Making a mistake on the lien form could invalidate your claim in Texas.

File your lien with the recorder’s office in the county where the property is located, and pay the recording fee. View a full list of Texas recorder’s offices to find contact information, fees, and filing requirements.

Your job isn’t done when the lien is filed; a Texas mechanics lien doesn’t last forever. If you are not paid, you will need to enforce your lien claim before the deadline expires.

If the property owner or other paying party asks you to discharge or cancel your lien, you must file a lien release within 10 days of the request.

We have a wide range of topics covered in our webinars and short video series. Watch more videos.

The provisions of the Texas mechanics lien statutes that permit the filing of mechanics liens and materialman’s liens on construction projects can be found in Texas’s Mechanics’ Lien Law, V.T.C.A. Property Code § 53.001 et. seq. The full text of the Texas Construction Lien Law is provided below. Updated as of May 2023.

NOTE: Texas lien laws went through extensive changes that are effective on all original contracts entered into on or after 1/1/22 (i.e. prime contracts signed on or after 1/1/22)

In this chapter:

(1) “Contract price” means the cost to the owner for any part of construction or repair performed under an original contract.

(2) “Improvement” includes:

(A) a house, building, structure, parking structure, physical appurtenance, pool, utility, railroad, well, storage facility, abutting sidewalks and streets, utilities in or on those sidewalks and streets, land reclaimed from overflow, and other fixtures or modifications to real property;

(B) clearing, grubbing, draining, or fencing of land;

(C) machinery or apparatuses used for raising water or for supplying or storing water for stock, domestic use, or irrigation ;

(D) work described by Section 53.021(4) ; and

(E) a design, drawing, plan, plat, survey, or specification provided by a licensed architect, engineer, or surveyor .

(A) labor used in the direct performance of the work; or

(B) a professional service used in the direct preparation for the work of a design, drawing, plan, plat, survey, or specification.

(4) “Material” means all or part of:

(A) the material, machinery, fixtures, or tools:

(i) incorporated into the work;

(ii) used in the direct performance of the work;

(iii) specially fabricated for an improvement; or

(iv) ordered and delivered for incorporation or use ;

(B) rent at a reasonable rate and actual running repairs at a reasonable cost for construction equipment used or reasonably required and delivered for use in the direct performance of the work at the site of the construction or repair; or

(C) power, water, fuel, and lubricants consumed or ordered and delivered for consumption in the direct performance of the work.

(5) “Mechanic’s lien” means the lien provided by this chapter.

(6) “Original contract” means an agreement to which an owner is a party either directly or by implication of law.

(7) “Original contractor” means a person contracting with an owner either directly or through the owner’s agent.

(7-a) “Purported original contractor” means an original contractor who can effectively control the owner or is effectively controlled by the owner through common ownership of voting stock or ownership interests, interlocking directorships, common management, or otherwise, or who was engaged by the owner for the construction or repair of improvements without a good faith intention of the parties that the purported original contractor was to perform under the contract. For purposes of this subdivision, the term “owner” does not include a person who has or claims a security interest only.

(8) “Residence” means the real property and improvements for a single-family house, duplex, triplex, or quadruplex or a unit in a multiunit structure used for residential purposes in which title to the individual units is transferred to the owners under a condominium or cooperative system that is:

(A) owned by one or more adult persons; and

(B) used or intended to be used as a dwelling by one of the owners.

(9) “Residential construction contract” means a contract between an owner and a contractor in which the contractor agrees to construct or repair the owner’s residence, including improvements appurtenant to the residence.

(10) “Residential construction project” means a project for the construction or repair of a new or existing residence, including improvements appurtenant to the residence, as provided by a residential construction contract.

(11) “Retainage” means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered.

(12) “Specially fabricated material” means material fabricated for use as a component of the construction or repair so as to be reasonably unsuitable for use elsewhere.

(13) “Subcontractor” means a person who labors or has furnished labor or materials to fulfill an obligation to an original contractor or to a subcontractor of any tier to perform all or part of the work required by an original contract.

(14) “Work” means any part of construction or repair of an improvement performed under an original contract.

(15) “Completion” of an original contract means the actual completion of the work, including any extras or change orders reasonably required or contemplated under the original contract, other than warranty work or replacement or repair of the work performed under the contract.

On any work there may be more than one original contractor for purposes of this chapter.

(a) [Repealed by 2021 amendment.]

(b) Except as provided by Subsection (c) or (d), any notice or other written communication required by this chapter must be delivered:

(1) in person to the party entitled to the notice or to that party’s agent;

(2) by certified mail; or

(3) by any other form of traceable, private delivery or mailing service that can confirm proof of receipt.

(c) If notice is sent by certified mail, deposit or mailing of the notice in the United States mail in the form required constitutes compliance with the notice requirement. This subsection does not apply if the law requires receipt of the notice by the person to whom it is directed.

(d) If a written notice is received by the person entitled to receive it, the method by which the notice was delivered is immaterial.

(e) In computing the period of days in which to provide a notice or to take any action required under this chapter, if the last day of the period is a Saturday, Sunday, or legal holiday, the period is extended to include the next day that is not a Saturday, Sunday, or legal holiday.

A person has a lien if the person, under a contract with the owner or the owner’s agent, trustee, receiver, contractor, or subcontractor:

(1) labors or furnishes labor or materials for construction or repair of an improvement;

(2) specially fabricates material, even if the material is not delivered;

(3) is a licensed architect, engineer, or surveyor providing services to prepare a design, drawing, plan, plat, survey, or specification;

(4) provides labor, plant material, or other supplies for the installation of landscaping for an improvement, including the construction of a retention pond, retaining wall, berm, irrigation system, fountain, or other similar installation; or

(5) performs labor as part of, or furnishes labor or materials for, the demolition of an improvement on real property .

(a) The lien extends to the improvements and to each lot of land necessarily connected .

(b) The lien does not extend to abutting sidewalks, streets, and utilities that are public property.

(c) A lien against land in a city, town, or village extends to each lot on which the improvement is situated or on which the labor was performed.

(d) A lien against land not in a city, town, or village extends to not more than 50 acres on which the improvement is situated or on which the labor was performed.

The lien secures payment for:

(1) the labor done or material furnished for the construction, repair, design, survey, or demolition; or

(2) the specially fabricated material, even if the material has not been delivered or incorporated into the construction or repair, less its fair salvage value.

The amount of a lien claimed by a subcontractor may not exceed:

(1) an amount equal to the proportion of the total subcontract price that the sum of the labor performed, materials furnished, materials specially fabricated, reasonable overhead costs incurred, and proportionate profit margin bears to the total subcontract price; minus

(2) the sum of previous payments received by the claimant on the subcontract.

A lien for retainage is valid only for the amount specified to be retained in the contract, including any amendments to the contract, between the claimant and the original contractor or between the claimant and a subcontractor.

(a) A person who labors or furnishes labor or materials under a direct contractual relationship with a purported original contractor is considered to be an original contractor for purposes of perfecting a mechanic’s lien.

(b) [Repealed by 2021 amendment.]

To perfect the lien, a person must comply with this subchapter.

(a) An original contractor claiming the lien must file an affidavit with the county clerk:

(1) for projects other than residential construction projects, not later than the 15th day of the fourth month after the month in which the original contractor’s work was completed, terminated, or abandoned; or

(2) for residential construction projects, not later than the 15th day of the third month after the month in which the original contractor’s work was completed, terminated, or abandoned.

(b) Except as provided by Subsection (c) or (d) , a claimant other than an original contractor claiming the lien must file an affidavit with the county clerk not later than the 15th day of the fourth month after the later of:

(1) the month the claimant last provided labor or materials; or

(2) the month the claimant would normally have been required to deliver the last of specially fabricated materials that have not been actually delivered .

(c) A claimant other than an original contractor claiming a lien arising from a residential construction project must file an affidavit with the county clerk not later than the 15th day of the third month after the later of:

(1) the month the claimant last provided labor or materials; or

(2) the month the claimant would normally have been required to deliver the last of specially fabricated materials that have not been actually delivered.

(d) A claimant other than an original contractor claiming a lien for retainage must file an affidavit with the county clerk not later than the 15th day of the third month after the month in which the original contract under which the claimant performed was completed, terminated, or abandoned.

(e) An affidavit under this chapter must be filed in the county where the improvements are located .

The county clerk shall record the affidavit in records kept for that purpose and shall index and cross-index the affidavit in the names of the claimant, the original contractor, and the owner. Failure of the county clerk to properly record or index a filed affidavit does not invalidate the lien.

(a) The affidavit must be signed by the person claiming the lien or by another person on the claimant’s behalf and must contain substantially:

(1) a sworn statement of the amount of the claim;

(2) the name and last known address of the owner or reputed owner;

(3) a general statement of the kind of work done and materials furnished by the claimant and, for a claimant other than an original contractor, a statement of each month in which the work was done and materials furnished for which payment is requested;

(4) the name and last known address of the person by whom the claimant was employed or to whom the claimant furnished the materials or labor;

(5) the name and last known address of the original contractor;

(6) a description, legally sufficient for identification, of the property sought to be charged with the lien;

(7) the claimant’s name, mailing address, and, if different, physical address; and

(8) for a claimant other than an original contractor, a statement identifying the date each notice of the claim was sent to the owner and the method by which the notice was sent.

(b) The claimant may attach to the affidavit a copy of any applicable written agreement or contract and a copy of each notice sent to the owner.

(c) The affidavit is not required to set forth individual items of work done or material furnished or specially fabricated. The affidavit may use any abbreviations or symbols customary in the trade.

(a) A person who files an affidavit must send a copy of the affidavit to the owner or reputed owner at the owner’s last known business or residence address not later than the fifth day after the date the affidavit is filed with the county clerk.

(b) If the person is not an original contractor, the person must also send a copy of the affidavit to the original contractor at the original contractor’s last known business or residence address within the same period.

(a) Except as provided by Section 53.057 , a claimant other than an original contractor must give the notice prescribed by Subsections (a-1) and (a-2) for the lien to be valid.

(a-1) For all unpaid labor or materials provided, the claimant must send a notice of claim for unpaid labor or materials to the owner or reputed owner and the original contractor. The notice must be sent:

(1) for projects other than residential construction projects, not later than the 15th day of the third month after the month during which:

(A) the labor or materials were provided; or

(B) the undelivered specially fabricated materials would normally have been delivered; or

(2) for residential construction projects, not later than the 15th day of the second month after the month during which:

(A) the labor or materials were provided; or

(B) the undelivered specially fabricated materials would normally have been delivered.

(a-2) The notice must be in substantially the following form:

“NOTICE OF CLAIM FOR UNPAID LABOR OR MATERIALS

“WARNING: This notice is provided to preserve lien rights.

“Owner’s property may be subject to a lien if sufficient funds are not withheld from future payments to the original contractor to cover this debt.

“Project description and/or address: _______________

“Claimant’s name: _______________

“Type of labor or materials provided: _______________

“Original contractor’s name: _______________

“Party with whom claimant contracted if different from original contractor: _______________

“Claim amount: _______________

“_______________ (Claimant’s contact person)

“_______________ (Claimant’s address)”

(a-3) The notice may include an invoice or billing statement.

(a-4) A claimant may give to the original contractor a written notice of an unpaid labor or materials invoice that is past due. A notice under this subsection is not required for a lien to be valid.

(a) To the extent that a claim for unpaid retainage is not included wholly or partly in a notice provided under Section 53.056, a claimant other than an original contractor whose contract provides for retainage must give notice under this section for a lien for unpaid retainage to be valid .

(a-1) The claimant must send the notice of claim for unpaid retainage to the owner or reputed owner and the original contractor not later than the earlier of:

(1) the 30th day after the date the claimant’s contract is completed, terminated, or abandoned; or

(2) the 30th day after the date the original contract is terminated or abandoned.

(a-2) The notice must be in substantially the following form:

“NOTICE OF CLAIM FOR UNPAID RETAINAGE”

WARNING: This notice is provided to preserve lien rights.”Owner’s property may be subject to a lien if sufficient funds are not withheld from future payments to the original contractor to cover this debt.

“Project description and/or address: ________________

“Claimant’s name: ________________

“Type of labor or materials provided: ________________

“Original contractor’s name: ________________

“Party with whom claimant contracted if different from original contractor: ________________

“Total retainage unpaid: ________________

“________________ (Claimant’s contact person)

“________________ (Claimant’s address)”

(a-3) The notice may include an invoice or billing statement.

(b) [Repealed by 2021 amendment.]

(b-1) [Repealed by 2021 amendment.]

(c) [Repealed by 2021 amendment.]

(d) [Repealed by 2021 amendment.]

(e) [Repealed by 2021 amendment.]

(f) A claimant has a lien on, and the owner is personally liable to the claimant for, the reserved funds under Subchapter E if the claimant:

(1) gives notice in accordance with this section and:

(A) complies with Subchapter E; or

(B) files an affidavit claiming a lien not later than

the date required for filing an affidavit under the applicable provision of Section 53.052; and

(2) gives the notice of the filed affidavit as required by Section 53.055.

(g) [Repealed by 2021 amendment.]

(a) If an owner receives notice under Section 53.056 or 53.057, the owner may withhold from payments to the original contractor an amount necessary to pay the claim for which he receives notice. The withholding may be in addition to any reserved funds.

(b) If notice is sent under Section 53.056 , the owner may withhold the funds immediately on receipt of the notice.

(c) If notice is sent under Section 53.057, the owner may withhold funds immediately on receipt of a copy of the claimant’s affidavit prepared in accordance with Sections 53.052 through 53.055.

(d)[Repealed by 2021 amendment.]

Unless the claim is otherwise settled, discharged, indemnified against under Subchapter H or I, or determined to be invalid by a final judgment of a court, the owner shall retain the funds withheld until:

(1) the time for filing the affidavit of mechanic’s lien has passed; or

(2) if a lien affidavit has been filed, the lien claim has been satisfied or released.

(a) Except for the amount the owner fails to reserve under Subchapter E, the owner is not liable for any amount paid to the original contractor before the owner is authorized to withhold funds under this subchapter.

(b) If the owner has received a notice required by Section 53.056 or 53.057 , if the lien has been secured, and if the claim has been reduced to final judgment, the owner is liable and the owner’s property is subject to a claim for any money paid to the original contractor after the owner was authorized to withhold funds under this subchapter. The owner is liable for that amount in addition to any amount for which the owner is liable under Subchapter E.

(a) Any person who furnishes labor or materials for the construction of improvements on real property shall, if requested and as a condition of payment for such labor or materials, provide to the requesting party, or the party’s agent, an affidavit stating that the person has paid each of the person’s subcontractors, laborers, or materialmen in full for all labor and materials provided to the person for the construction. In the event, however, that the person has not paid each of the person’s subcontractors, laborers, or materialmen in full, the person shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each subcontractor, laborer, or materialman to whom the payment is owed.

(b) The seller of any real property shall, upon request by the purchaser or the purchaser’s agent prior to closing of the purchase of the real property, provide to the purchaser or the purchaser’s agent, a written affidavit stating that the seller has paid each of the seller’s contractors, laborers, or materialmen in full for all labor and materials provided to the seller through the date specified in the affidavit for any construction of improvements on the real property and that the seller is not indebted to any person, firm, or corporation by reason of any such construction through the date specified in the affidavit. In the event that the seller has not paid each of the seller’s contractors, laborers, or materialmen in full for labor and material provided through the date specified in the affidavit, the seller shall state in the affidavit the amount owed and the name and, if known, the address and telephone number of each contractor, laborer, or materialman to whom the payment is owed.

(c) The affidavit may include:

(1) a waiver or release of lien rights or payment bond claims by the affiant that is conditioned on the receipt of actual payment or collection of funds when payment is made by check or draft, as provided by Subchapter L;

(2) a warranty or representation that certain bills or classes of bills will be paid by the affiant from funds paid in reliance on the affidavit; and

(3) an indemnification by the affiant for any loss or expense resulting from false or incorrect information in the affidavit.

(d) A person, including a seller, commits an offense if the person intentionally, knowingly, or recklessly makes a false or misleading statement in an affidavit under this section. An offense under this section is a misdemeanor. A person adjudged guilty of an offense under this section shall be punished by a fine not to exceed $4,000 or confinement in jail for a term not to exceed one year or both a fine and confinement. A person may not receive community supervision for the offense.

(e) A person signing an affidavit under this section is personally liable for any loss or damage resulting from any false or incorrect information in the affidavit.

(a) During the progress of work under an original contract for which a mechanic’s lien may be claimed and for 30 days after the work under the contract is completed, the owner shall reserve :

(1) 10 percent of the contract price of the work to the owner; or

(2) 10 percent of the value of the work, measured by the proportion that the work done bears to the work to be done, using the contract price or, if there is no contract price, using the reasonable value of the completed work.

(b) In this section, “owner” includes the owner’s agent, trustee, or receiver.

The reserved funds secure the payment of artisans and mechanics who perform labor or service and the payment of other persons who furnish material, material and labor, or specially fabricated material for any contractor, subcontractor, agent, or receiver in the performance of the work.

A claimant has a lien on the reserved funds if the claimant:

(1) sends the notices required by this chapter in the time and manner required; and

(2) except as allowed by Section 53.057(f), files an affidavit claiming a lien not later than the 30th day after the earliest of the date:

(A) the work is completed;

(B) the original contract is terminated; or

(C) the original contractor abandons performance under the original contract.

(a) Individual artisans and mechanics are entitled to a preference to the reserved funds and shall share proportionately to the extent of their claims for wages and fringe benefits earned.

(b) After payment of artisans and mechanics who are entitled to a preference under Subsection (a), other participating claimants share proportionately in the balance of the reserved funds.

(a) If the owner fails or refuses to comply with this subchapter, the claimants complying with Subchapter C or this subchapter have a lien, at least to the extent of the amount that should have been reserved from the original contract under which they are claiming, against the improvements and all of its properties and against the lot or lots of land necessarily connected.

(b) The claimants share the lien proportionately in accordance with the preference provided by Section 53.104.

(a) An owner may file with the county clerk of the county in which the property is located an affidavit of completion. The affidavit must contain:

(1) the name and address of the owner;

(2) the name and address of the original contractor;

(3) a description, legally sufficient for identification, of the real property on which the improvements are located;

(4) a description of the improvements furnished under the original contract;

(5) a statement that the improvements under the original contract have been completed and the date of completion; and

(6) a conspicuous statement that a claimant may not have a lien on retained funds unless the claimant files an affidavit claiming a lien in the time and manner required by this chapter .

(b) A copy of the affidavit must be sent to the original contractor and to each claimant who sends a notice to the owner under Section 53.056 or 53.057 not later than the third day after the date the affidavit is filed or the 10th day after the date the owner receives the notice of lien liability, whichever is later.

(c) A copy of the affidavit must also be sent to each person who furnishes labor or materials for the property and who furnishes the owner with a written request for the copy. The owner must furnish the copy to the person not later than the date the affidavit is filed or the 10th day after the date the request is received, whichever is later.

(d) An affidavit filed under this section is prima facie evidence of the date the work under the original contract is completed for purposes of this chapter . If the affidavit is filed after the 10th day after the date of completion, the date of completion for purposes of this subchapter is the date the affidavit is filed. This subsection does not apply to a person to whom the affidavit was not sent as required by this section.

(a) Not later than the 10th day after the date an original contract is terminated or the original contractor abandons performance under the original contract, the owner shall give notice to each subcontractor who, before the date of termination or abandonment, has:

(1) given notice to the owner as provided by Section 53.056 or 53.057 ; or

(2) sent to the owner a written request for notice of termination or abandonment.

(b) The notice must contain:

(1) the name and address of the owner;

(2) the name and address of the original contractor;

(3) a description, legally sufficient for identification, of the real property on which the improvements are located;

(4) a general description of the improvements agreed to be furnished under the original contract;

(5) a statement that the original contract has been terminated or that performance under the contract has been abandoned;

(6) the date of the termination or abandonment; and

(7) a conspicuous statement that a claimant may not have a lien on the retained funds unless the claimant files an affidavit claiming a lien in the time and manner required by this chapter .

(c) A notice sent in compliance with this section on or before the 10th day after the date of termination or abandonment is prima facie evidence of the date the original contract was terminated or work was abandoned for purposes of this subchapter.

(d) If an owner is required to send a notice to a subcontractor under this section and fails to send the notice, the subcontractor is not required to comply with Section 53.057 to claim retainage and may claim a lien by filing a lien affidavit as prescribed by Section 53.052.

(e) This section does not apply to a residential construction project.

All subcontractors, laborers, and materialmen who have a mechanic’s lien have preference over other creditors of the original contractor.

(a) Except as provided by Subchapter E and Section 53.124(e), perfected mechanic’s liens are on equal footing without reference to the date of filing the affidavit claiming the lien.

(b) If the proceeds of a foreclosure sale of property are insufficient to discharge all mechanic’s liens against the property, the proceeds shall be paid pro rata on the perfected mechanic’s liens on which suit is brought.

(c) This chapter does not affect the contract between the owner and the original contractor as to the amount, manner, or time of payment of the contract price.

(a) Except as provided by this section, a mechanic’s lien attaches to the house, building, improvements, or railroad property in preference to any prior lien, encumbrance, or mortgage on the land on which it is located, and the person enforcing the lien may have the house, building, improvement, or any piece of the railroad property sold separately.

(b) The mechanic’s lien does not affect any lien, encumbrance, or mortgage on the land or improvement at the time of the inception of the mechanic’s lien, and the holder of the lien, encumbrance, or mortgage need not be made a party to a suit to foreclose the mechanic’s lien.

(a) Except as provided by Subsection (e), for purposes of Section 53.123, the time of inception of a mechanic’s lien is the commencement of construction of improvements or delivery of materials to the land on which the improvements are to be located and on which the materials are to be used.

(b) The construction or materials under Subsection (a) must be visible from inspection of the land on which the improvements are being made.

(c) An owner and original contractor may jointly file an affidavit of commencement with the county clerk of the county in which the land is located not later than the 30th day after the date of actual commencement of construction of the improvements or delivery of materials to the land. The affidavit must contain:

(1) the name and address of the owner;

(2) the name and address of each original contractor, known at the time to the owner, that is furnishing labor, service, or materials for the construction of the improvements;

(3) a description, legally sufficient for identification, of the property being improved;

(4) the date the work actually commenced; and

(5) a general description of the improvement.

(d) An affidavit filed in compliance with this section is prima facie evidence of the date of the commencement of the improvement described in the affidavit. The time of inception of a mechanic’s lien arising from work described in an affidavit of commencement is the date of commencement of the work stated in the affidavit.

(e) The time of inception of a lien that is created under Section 53.021(c), (d), or (e) is the date of recording of an affidavit of lien under Section 53.052. The priority of a lien claimed by a person entitled to a lien under Section 53.021(c), (d), or (e) with respect to other mechanic’s liens is determined by the date of recording. A lien created under Section 53.021(c), (d), or (e) is not valid or enforceable against a grantee or purchaser who acquires an interest in the real property before the time of inception of the lien.

(a) A creditor of an original contractor may not collect, enforce a security interest against, garnish, or levy execution on the money due the original contractor or the contractor’s surety from the owner, and a creditor of a subcontractor may not collect, enforce a security interest against, garnish, or levy execution on the money due the subcontractor, to the prejudice of the subcontractors, mechanics, laborers, materialmen, or their sureties.

(b) A surety issuing a payment bond or performance bond in connection with the improvements has a priority claim over other creditors of its principal to contract funds to the extent of any loss it suffers or incurs. That priority does not excuse the surety from paying any obligations that it may have under its payment bonds.

(a) When a debt for labor or materials is satisfied or paid by collected funds, the person who furnished the labor or materials shall, not later than the 10th day after the date of receipt of a written request, furnish to the requesting person a release of the indebtedness and any lien claimed, to the extent of the indebtedness paid. An owner, the original contractor, or any person making the payment may request the release.

(b) A release of lien must be in a form that would permit it to be filed of record.

(a) If an affidavit claiming a mechanic’s lien is filed by a person other than the original contractor, the original contractor shall defend at his own expense a suit brought on the claim.

(b) If the suit results in judgment on the lien against the owner or the owner’s property, the owner is entitled to deduct the amount of the judgment and costs from any amount due the original contractor. If the owner has settled with the original contractor in full, the owner is entitled to recover from the original contractor any amount paid for which the original contractor was originally liable.

A mechanic’s lien may be foreclosed only on judgment of a court of competent jurisdiction foreclosing the lien and ordering the sale of the property subject to the lien.

If the improvement is sold separately from the land, the officer making the sale shall provide the purchaser a reasonable time after the date of purchase within which to remove and take possession of the purchased improvement.

In any proceeding to foreclose a lien or to enforce a claim against a bond issued under Subchapter H, I, or J or in any proceeding to declare that any lien or claim is invalid or unenforceable in whole or in part, the court shall award costs and reasonable attorney’s fees as are equitable and just. With respect to a lien or claim arising out of a residential construction contract, the court is not required to order the property owner to pay costs and attorney’s fees under this section.

An affidavit claiming a mechanic’s lien filed under Section 53.052 may be discharged of record by:

(1) recording a lien release signed by the claimant under Section 53.152;

(2) failing to institute suit to foreclose the lien in the county in which the improvement is located within the period prescribed by Section 53.158, 53.175, or 53.208;

(3) recording the original or certified copy of a final judgment or decree of a court of competent jurisdiction providing for the discharge;

(4) filing the bond and notice in compliance with Subchapter H;

(5) filing the bond in compliance with Subchapter I; or

(6) recording a certified copy of the order removing the lien under Section 53.160, provided that no bond or deposit as described by Section 53.161 was filed by the claimant within 30 days after the date the order was entered.

(a) Except as provided by Subsection (a-2) , suit must be brought to foreclose the lien not later than the first anniversary of the last day a claimant may file the lien affidavit under Section 53.052 .

(a-1) Notwithstanding Section 16.069, Civil Practice and Remedies Code, or any other law, if suit is pursued solely to discharge a lien because limitations have expired on bringing a lien foreclosure suit, the lien claimant’s rights to pursue a suit to foreclose a lien are not revived.

(a-2) The limitations period established under Subsection (a) may be extended to not later than the second anniversary of the date the claimant filed the lien affidavit under Section 53.052 if, before the expiration of the limitations period established under Subsection (a), the claimant enters into a written agreement with the then-current record owner of the property to extend the limitations period. The agreement must be recorded with the clerk of the same county where the lien was recorded and is considered to be notice of the extension to any subsequent purchaser.

(b) [Repealed by 2021 amendment.]

(a) An owner, on written request, shall furnish the following information within a reasonable time, but not later than the 10th day after the date the request is received, to any person furnishing labor or materials for the project:

(1) a description of the real property being improved legally sufficient to identify it;

(2) whether there is a surety bond and if so, the name and last known address of the surety and a copy of the bond;

(3) whether there are any prior recorded liens or security interests on the real property being improved and if so, the name and address of the person having the lien or security interest; and

(4) the date on which the original contract for the project was executed.

(b) An original contractor, on written request by a person who furnished work under the original contract, shall furnish to the person the following information within a reasonable time, but not later than the 10th day after the date the request is received:

(1) the name and last known address of the person to whom the original contractor furnished labor or materials for the construction project;

(2) whether the original contractor has furnished or has been furnished a payment bond for any of the work on the construction project and if so, the name and last known address of the surety and a copy of the bond; and

(3) the date on which the original contract for the project was executed.

(c) A subcontractor, on written request by an owner of the property being improved, the original contractor, a surety on a bond covering the original contract, or any person furnishing work under the subcontract, shall furnish to the person the following information within a reasonable time, but not later than the 10th day after the date the request is received:

(1) the name and last known address of each person from whom the subcontractor purchased labor or materials for the construction project, other than those materials that were furnished to the project from the subcontractor’s inventory;

(2) the name and last known address of each person to whom the subcontractor furnished labor or materials for the construction project; and

(3) whether the subcontractor has furnished or has been furnished a payment bond for any of the work on the construction project and if so, the name and last known address of the surety and a copy of the bond.

(d) Not later than the 30th day after the date a written request is received from the owner, the contractor under whom a claim of lien or under whom a bond is made, or a surety on a bond on which a claim is made, a claimant for a lien or under a bond shall furnish to the requesting person a copy of any applicable written agreement, purchase order, or contract and any billing, statement, or payment request of the claimant reflecting the amount claimed and the work performed by the claimant for which the claim is made. If requested, the claimant shall provide the estimated amount due for each calendar month in which the claimant has performed labor or furnished materials.

(e) If a person from whom information is requested does not have a direct contractual relationship on the project with the person requesting the information, the person from whom information is requested, other than a claimant requested to furnish information under Subsection (d), may require payment of the actual costs, not to exceed $25, in furnishing the requested information.

(f) A person, other than a claimant requested to furnish information under Subsection (d), who fails to furnish information as required by this section is liable to the requesting person for that person’s reasonable and necessary costs incurred in procuring the requested information.

(a) In a suit brought to foreclose a lien or to declare a claim or lien invalid or unenforceable, a party objecting to the validity or enforceability of the claim or lien may file a motion to remove the claim or lien. The motion must be verified and state the legal and factual basis for objecting to the validity or enforceability of the claim or lien. The motion may be accompanied by supporting affidavits.

(b) The grounds for objecting to the validity or enforceability of the claim or lien for purposes of the motion are limited to the following:

(1) notice of claim was not timely furnished to the owner or original contractor as required by Section 53.056 or 53.057 ;

(2) an affidavit claiming a lien failed to comply with Section 53.054 or was not filed as required by Section 53.052;

(3) notice of the filed affidavit was not furnished to the owner or original contractor as required by Section 53.055;

(4) the deadlines for perfecting a lien claim for retainage under this chapter have expired and the owner complied with the requirements of Section 53.101 and paid the retainage and all other funds owed to the original contractor before:

(A) the claimant perfected the lien claim; and

(B) the owner received a notice of the claim as required by this chapter;

(5) all funds subject to the notice of a claim to the owner and a notice regarding the retainage have been deposited in the registry of the court and the owner has no additional liability to the claimant;

(6) when the lien affidavit was filed on homestead property:

(A) no contract was executed or filed as required by Section 53.254;

(B) the affidavit claiming a lien failed to contain the notice as required by Section 53.254; or

(C) the notice of the claim failed to include the statement required by Section 53.254; and

(7) the claimant executed a valid and enforceable waiver or release of the claim or lien claimed in the affidavit.

(c) The claimant is not required to file a response. The claimant and any other party that has appeared in the proceeding must be notified by at least 30 days before the date of the hearing on the motion. A motion may not be heard before the 30th day after the date the claimant answers or appears in the proceeding. The claimant must be allowed expedited discovery regarding information relevant to the issues listed under Subsection (b).

(d) At the hearing on the motion, the burden is on:

(1) the claimant to prove that the notice of claim and affidavit of lien were furnished to the owner and original contractor as required by this chapter; and

(2) the movant to establish that the lien should be removed for any other ground authorized by this section.

(e) The court shall promptly determine a motion to remove a claim or lien under this section. If the court determines that the movant is not entitled to remove the lien, the court shall enter an order denying the motion. If the court determines that the movant is entitled to remove the lien, the court shall enter an order removing the lien claimed in the lien affidavit. A party to the proceeding may not file an interlocutory appeal from the court’s order.

(f) Any admissible evidence offered at the hearing may be admitted in the trial of the case. The court’s order under Subsection (e) is not admissible as evidence in determining the validity and enforceability of the claim or lien.

(a) In the order removing a lien, the court shall set the amount of security that the claimant may provide in order to stay the removal of the claim or lien. The sum must be an amount that the court determines is a reasonable estimate of the costs and attorney’s fees the movant is likely to incur in the proceeding to determine the validity or enforceability of the lien. The sum may not exceed the amount of the lien claim.

(b) The court shall stay the order removing the lien if the claimant files a bond or a deposit in lieu of a bond in the amount set in the order with the clerk of the court not later than the 30th day after the date the order is entered by the court unless, for good cause, the court orders a later date for filing the bond or the deposit in lieu of a bond. If the court fails to set the amount of the security required, the amount required is the amount of the lien claim.

(c) The bond must be:

(1) executed by a corporate surety authorized to do business in this state and licensed by this state to execute bonds as surety; and

(2) conditioned on the claimant’s payment of any final judgment rendered against the claimant in the proceeding for attorney’s fees and costs to the movant under Section 53.156.

(d) In lieu of filing a bond, the claimant may deposit in the amount set by the court for the surety bond:

(2) a negotiable obligation of the federal government or a federal agency; or

(3) a negotiable obligation of a financial institution chartered by the federal or state government that is insured by the federal government or a federal agency.

(e) A deposit made under Subsection (d) must be conditioned in the same manner as a surety bond. Any interest accrued on the deposit amount is a part of the deposit.

(f) If the claimant fails to file the bond or the deposit in lieu of the bond in compliance with this section, the owner may file:

(1) a certified copy of the order; and

(2) a certificate from the clerk of the court stating that:

(A) no bond or deposit in lieu of the bond was filed within 30 days after the date the order was entered by the court; and

(B) no order staying the order to remove the lien was entered by the court.

(g) The claim or lien is removed and extinguished as to a creditor or subsequent purchaser for valuable consideration who obtains an interest in the property after the certified copy of the order and certificate of the clerk of the court are filed with the county clerk. The removal of the lien does not constitute a release of the liability of the owner, if any, to the claimant.

(a) If an order removing the lien is not stayed as provided by Section 53.161 and the claimant later obtains a final judgment in the suit establishing the validity and ordering the foreclosure of the lien, the claimant may file a certified copy of the final judgment with the county clerk.

(b) The filed judgment revives the lien, and the claimant may foreclose the lien.

(c) A lien revived under this section is void as to a creditor or subsequent purchaser for valuable consideration who obtained an interest in the property:

(1) after the order removing the lien and the certificate from the clerk of the court was filed with the county clerk; and

(2) before the final judgment reviving the lien was filed with the county clerk.

(a) If a lien, other than a lien granted by the owner in a written contract, is fixed or is attempted to be fixed by a recorded instrument under this chapter, any person may file a bond to indemnify against the lien.

(b) The bond shall be filed with the county clerk of the county in which the property subject to the lien is located.

(c) A mechanic’s lien claim against an owner’s property is discharged after:

(1) a bond that complies with Section 53.172 is filed;

(2) the notice of the bond is issued as provided by Section 53.173; and

(3) the bond and notice are recorded as provided by Section 53.174.

(1) describe the property on which the liens are claimed;

(2) refer to each lien claimed in a manner sufficient to identify it;

(3) be in an amount that is double the amount of the liens referred to in the bond unless the total amount claimed in the liens exceeds $40,000, in which case the bond must be in an amount that is the greater of 1-1/2 times the amount of the liens or the sum of $40,000 and the amount of the liens;

(4) be payable to the parties claiming the liens;

(5) be executed by:

(A) the party filing the bond as principal; and

(B) a corporate surety authorized and admitted to do business under the law in this state and licensed by this state to execute the bond as surety, subject to Section 1, Chapter 87, Acts of the 56th Legislature, Regular Session, 1959 (Article 7.19-1, Vernon’s Texas Insurance Code); and

(6) be conditioned substantially that the principal and sureties will pay to the named obligees or to their assignees the amount that the named obligees would have been entitled to recover if their claims had been proved to be valid and enforceable liens on the property.

(a) After the bond is filed, the county clerk shall issue notice of the bond to all named obligees.

(b) A copy of the bond must be attached to the notice.

(c) The notice must be served on each obligee by mailing a copy of the notice and the bond to the obligee by certified mail addressed to the claimant at the address stated in the lien affidavit for the obligee.

(d) If the claimant’s lien affidavit does not state the claimant’s address, the notice is not required to be mailed to the claimant.

(a) The county clerk shall record the bond, the notice, and a certificate of mailing in the real property records.

(b) In acquiring an interest in or insuring title to real property, a purchaser, insurer of title, or lender may rely on and is absolutely protected by the record of the bond and the notice to the same extent as if the lien claimant had filed a release of lien in the real property records.

(a) A party making or holding a lien claim may not sue on the bond later than one year after the date on which the notice is served or after the date on which the underlying lien claim becomes unenforceable under Section 53.158.

(b) The bond is not exhausted by one action against it. Each named obligee or assignee of an obligee may maintain a separate suit on the bond in any court of jurisdiction in the county in which the real property is located.

(a) An original contractor who has a written contract with the owner may furnish at any time a bond for the benefit of claimants.

(b) If a valid bond is filed, a claimant may not file suit against the owner or the owner’s property and the owner is relieved of obligations under Subchapter D or E.

(1) be in a penal sum at least equal to the total of the original contract amount;

(2) be in favor of the owner;

(3) have the written approval of the owner endorsed on it;

(4) be executed by:

(A) the original contractor as principal; and

(B) a corporate surety authorized and admitted to do business in this state and licensed by this state to execute bonds as surety, subject to Section 1, Chapter 87, Acts of the 56th Legislature, Regular Session, 1959 (Article 7.19-1, Vernon’s Texas Insurance Code);

(5) be conditioned on prompt payment for all labor, subcontracts, materials, specially fabricated materials, and normal and usual extras not exceeding 15 percent of the contract price; and

(6) clearly and prominently display on the bond or on an attachment to the bond:

(A) the name, mailing address, physical address, and telephone number, including the area code, of the surety company to which any notice of claim should be sent; or

(B) the toll-free telephone number maintained by the Texas Department of Insurance under Subchapter B, Chapter 521, Insurance Code, and a statement that the address of the surety company to which any notice of claim should be sent may be obtained from the Texas Department of Insurance by calling the toll-free telephone number.

(a) The bond and the contract between the original contractor and the owner shall be filed with the county clerk of the county in which is located all or part of the owner’s property on which the construction or repair is being performed or is to be performed. A memorandum of the contract or a copy of the contract may be substituted for the original.

(b) The plans, specifications, and general conditions of the contract are not required to be filed.

(c) The county clerk shall record the bond and place the contract on file in the clerk’s office and shall index and cross-index both in the names of the original contractor and the owner in records kept for that purpose.

(d) On request and payment of a reasonable fee, the county clerk shall furnish a copy of the bond and contract to any person.

(e) In any court of this state or in the United States, a copy of the bond and contract certified by the county clerk constitutes prima facie evidence of the contents, execution, delivery, and filing of the originals.

A purchaser, lender, or other person acquiring an interest in the owner’s property or an insurer of title is entitled to rely on the record of the bond and contract as constituting payment of all claims and liens for labor, subcontracts, materials, or specially fabricated materials incurred by the original contractor as if the purchaser, lender, or other person acquiring an interest in the owner’s property or an insurer of title were the owner who approved, accepted, and endorsed the bond and as if each person furnishing labor or materials for the work performed under the original contract, other than the original contractor, had filed a complete release and relinquishment of lien of record.

(a) The bond protects all persons with a claim that is:

(1) perfected in the manner prescribed for fixing a lien under Subchapter C ; or

(2) perfected in the manner prescribed by Section 53.206.

(b) A claim or the rights to a claim under the bond may be assigned.

(a) Except as provided by Subsection (b), to perfect a claim against a bond in a manner other than that prescribed by Subchapter C for fixing a lien, a person must give notice under Sections 53.056 and 53.057, as applicable, to the original contractor and surety on the bond.

(b) To perfect a claim for retainage under this section, a claimant is not required to give notice to the surety under Section 53.057 if the claimant has a direct contractual relationship with the original contractor.

(c) A claimant that provides the notices described by this section is not required to file an affidavit claiming a mechanic’s lien to perfect a claim under the bond.

(d) A person satisfies the requirements of this section relating to providing notice to the surety if the person mails the notice by certified mail to the surety:

(1) at the address stated on the bond or on an attachment to the bond;

(2) at the address on file with the Texas Department of Insurance; or

(3) at any other address allowed by law.

(a) If the owner receives any of the notices or a lien is fixed under this chapter , the owner shall mail to the surety on the bond a copy of all notices received.

(b) Failure of the owner to send copies of notices to the surety does not relieve the surety of any liability under the bond if the claimant has complied with the requirements of this subchapter, nor does that failure impose any liability on the owner.