Unless Congress acts, Americans are in for a tax hike in 2026.

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

Depending on the 2024 US election, the current corporate tax rate of 21 percent could be in for a change. See the modeling here.

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

A 15 percent corporate rate would be pro-growth, but it would not address the structural issues with today’s corporate tax base.

Tax Proposals in Historical Context Largest Tax Increase and Largest Tax Hike in History and Largest Tax Decrease and Largest Tax Cut in History" width="300" height="188" />

Tax Proposals in Historical Context Largest Tax Increase and Largest Tax Hike in History and Largest Tax Decrease and Largest Tax Cut in History" width="300" height="188" />

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

A higher tax burden for private infrastructure investments like wireless spectrum, 5G technology, and machinery and equipment makes an existing problem worse—especially against the backdrop of outright state subsidies in countries like China.

A new trade war could wipe out the benefits of pro-growth tax reform.

The Treasury Department recently touted strong business investment in the years following the pandemic-driven recession and pointed to the Biden administration’s industrial policies in the Inflation Reduction Act and CHIPS Act as key drivers.

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

While neither full expiration nor a deficit-financed full extension of the TCJA would be appropriate, lawmakers should consider the incentive effects of whichever tax reform they pursue. Because taxes affect the economy, they also affect the sustainability of debt reduction.

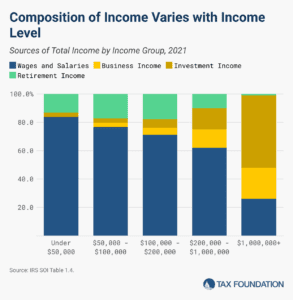

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

Page 1 of 19 1 2345678910 . LastStay informed on the tax policies impacting you.

About

Since 1937, our principled research, insightful analysis, and engaged experts have informed smarter tax policy in the U.S. and internationally. For over 80 years, our mission has remained the same: to improve lives through tax policies that lead to greater economic growth and opportunity.

Donate

As a nonprofit, we depend on the generosity of individuals like you.