Understanding each section of your monthly credit card statement is key to managing your credit card account and finances. Reviewing your monthly statement can help you balance your budget and ensure there are no errors or fraudulent charges.

But how do you navigate a credit card statement? Follow our easy-to-read guide and learn how to locate transactions, payments, your credit score, and more. Using a Discover ® credit card statement, we’ll also help you decode the terminology, numbers, and interest rates that make up your statement. And while not all statements look the same, most include basics like account information, payment due date, transaction history, and credit limit information. So, let’s get started.

Think of a credit card statement as an in-depth summary of how you’ve used your credit card throughout a billing cycle. Once a month, your credit card issuer will issue a new statement packed with important details such as your transaction history and payment due date. Some credit card statements also include information about your credit score.

Your most recent credit card statement should be available online (by logging into your account) and by mail (based on your paperless billing preference). Your credit issuer must send your statement at least 21 days before payment is due per the Office of the Comptroller of Currency.

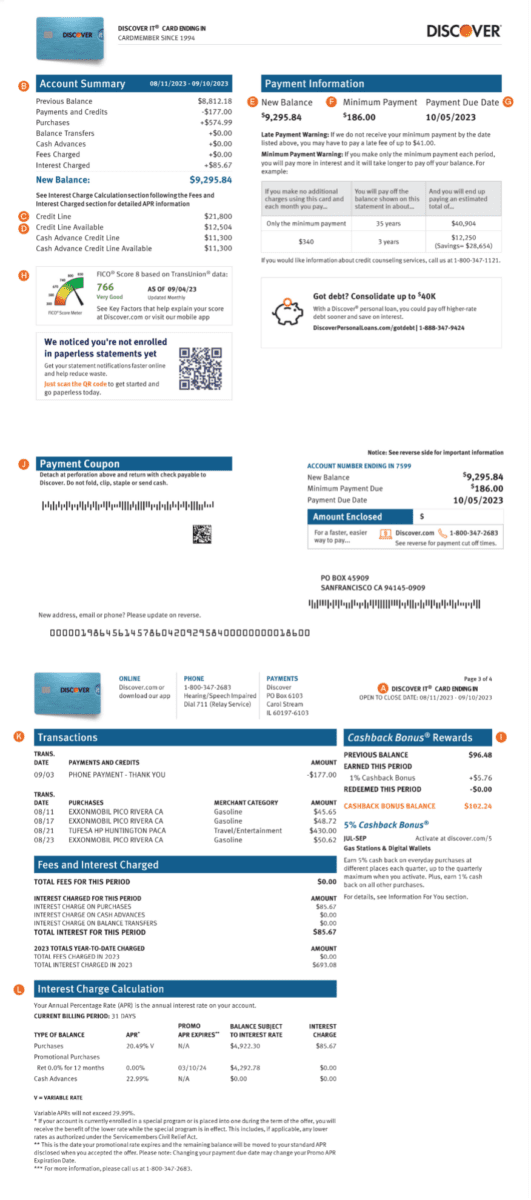

At an overview, you’ll most likely see your statement broken into sections with headers that indicate what each section contains.

Using the overview of our example statement, you can learn about each lettered section by finding the corresponding letter that explains it below.

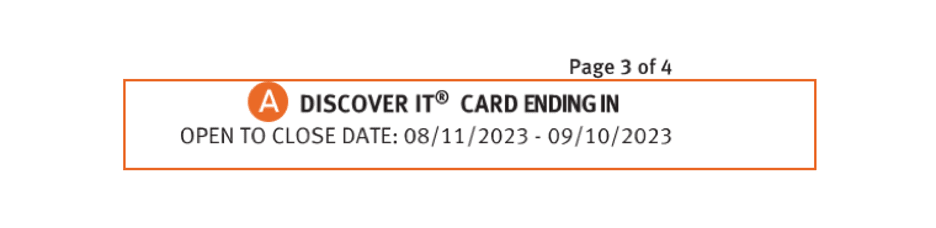

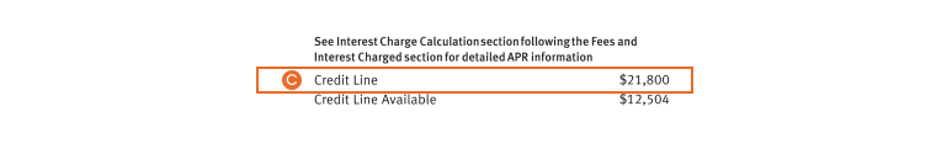

A. Account information: This section includes some of your basic account information, like the last four digits of your account number.

B. Account summary: An account summary often includes your billing cycle's start and end date, the previous balance from the last billing cycle, and a list of the sums for each transaction category within the current billing cycle. Categories may include payments and credits, purchases, balance transfers, cash advances, fees, and interest charges. An account summary also provides credit line information.

C. Credit line: Your credit line represents your spending limit.

D. Credit line available: Your available credit equals your credit limit minus your outstanding balance (purchase amounts, cash advances, and applicable interest and fees).

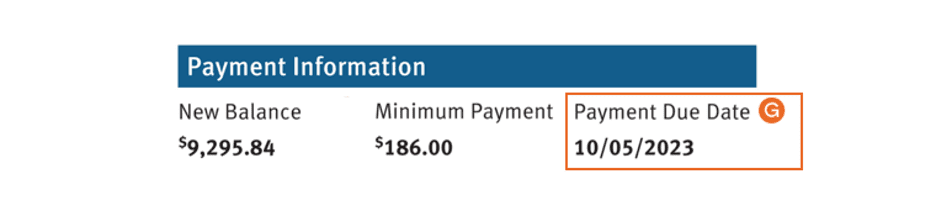

E. New balance: The payment information section of a credit card statement should list your new balance. Your new balance represents the amount of credit you’ve used plus any fees and interest as of the statement close date.

F. Minimum payment due: The payment information section of a credit card statement should also list your minimum payment due. You must pay at least this much by the payment due date to keep your account in good standing. But you can always pay more than the minimum, up to the total balance.

G. Payment due date: You should find your payment due date in the payment information section of a credit card statement.You'll likely get charged a late fee if you don't pay the minimum amount by the due date, and paying your credit card late can have other consequences.

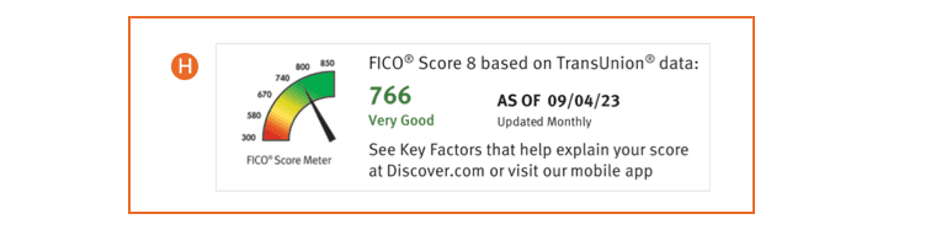

H. Credit score: You may find your credit score under the Account Summary section of your credit card statement. 90% of top lenders use FICO ® Credit Scores, including Discover. 1

Your credit score is a three-digit number that grades the information on your credit report—the higher the number, the better your credit. Lenders use your credit score to assess your reliability as a borrower, which can influence the approval and terms for car loans, mortgages, credit cards, and more

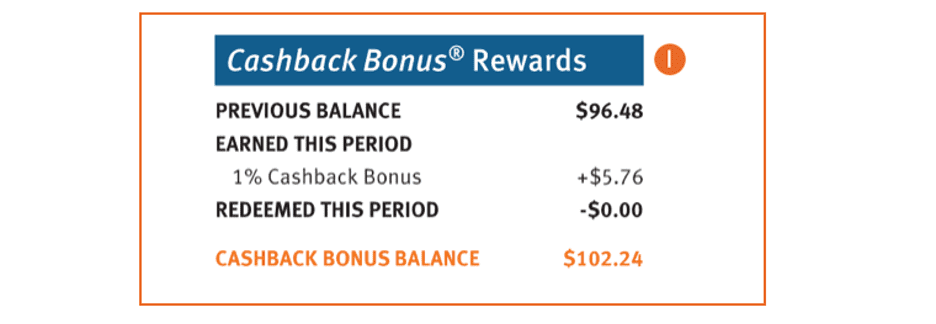

I. Rewards: The rewards section of your credit card statement should document the amount of cash back, miles, etc., you’ve accrued previously and how much you’ve accumulated in your current billing cycle.

Every Discover Card earns rewards on purchases . Choose the card that earns the type of rewards that are most valuable for you.

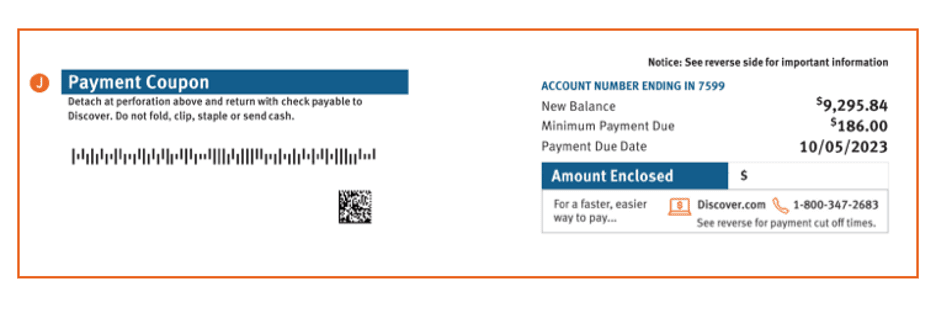

J. Payment coupon: If you opt for a paper statement, it’ll likely have a payment coupon to include with your check if paying by mail. All the necessary payment information will appear on the coupon.

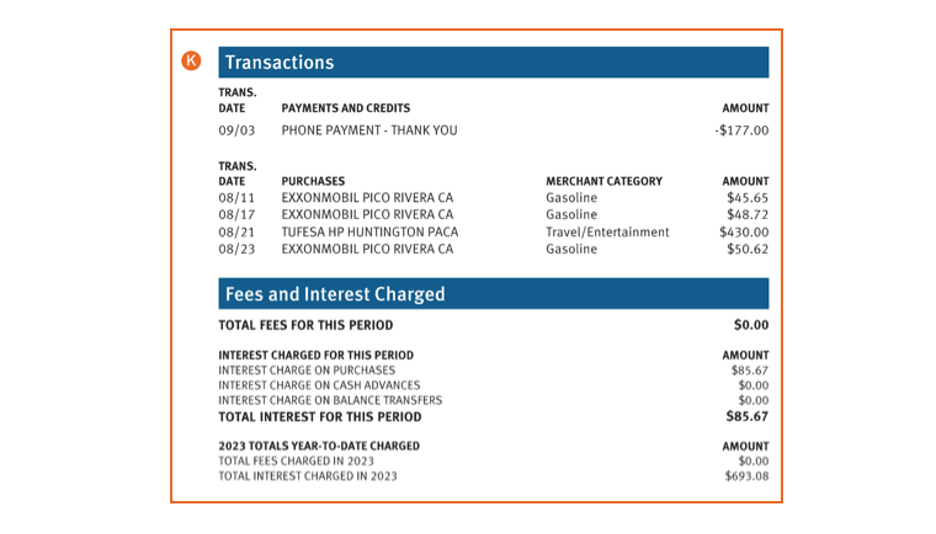

K. Transactions, fees, and interest: In the transactions section, you'll find the breakdown of each charge and payment for that billing cycle, listed by date.

A credit card statement's fees and interest section will show you what, if any, fees or interest you have incurred during your billing cycle and your total fees and interest for the year.

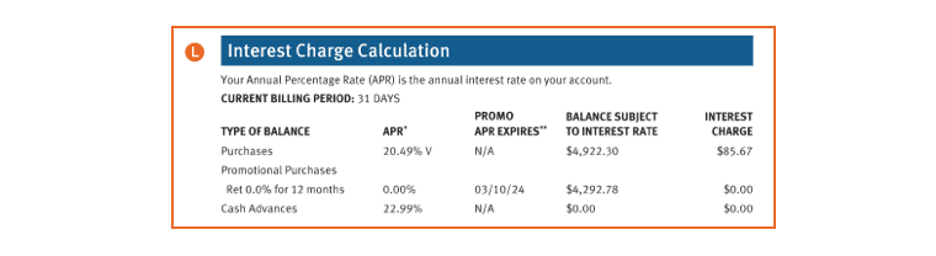

L. Interest type and charges: Your credit card statement might include a breakdown of your interest charges by transaction category and relevant interest rate, like in this interest charge calculation section.Here, you’ll find the annual percentage rates or APRs (for example, purchase APR and cash advance APR) that currently apply to your account, the balances subject to those rates, and the interest charges.

This section may also document what type of APR you have, a variable (fluctuates) or fixed (usually remains the same). Most credit cards offer a variable rate.

Your credit card statement balance reflects what you owe your card issuer as of the close of your billing cycle (when your billing cycle ends, and your balance gets reported to credit bureaus).

Remember: a credit card statement balance is just a snapshot of one billing cycle. On the other hand, your current balance is like a live feed of your account information. It may show a different amount than your credit card statement balance because of transactions made, and fees charged since your last statement was published.

Your credit card statement balance is the number you should pay off every month to avoid interest. If you think you may miss your statement, you may want to set up automatic bill pay to avoid paying late.

Along with a monthly credit card statement, you should receive a year-end statement from your credit card company outlining your card activity for the calendar year.

After the year rolls to a close, your year-end statement summarizes the total amount of your purchases, cash advances, and balance transfers for the year. These figures may not reflect your current balance, but they can offer a helpful view of credit card activities for the year.

Your year-end statement may also sort your yearly transactions into spending categories.Sorting your transaction totals can offer a useful overview of your spending patterns, allowing you to see where you’re on track with your budget and where it may need work. Sorting transactions can also help you find tax-deductible expenses. This may be particularly helpful for someone who is self-employed and using their personal credit card for business expenses.

Whether a monthly or year-end statement, understanding how to follow and process your statement details can help you better manage your spending, payments, and even your taxes. Use this guide as a resource for decoding your next credit card statement.